|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

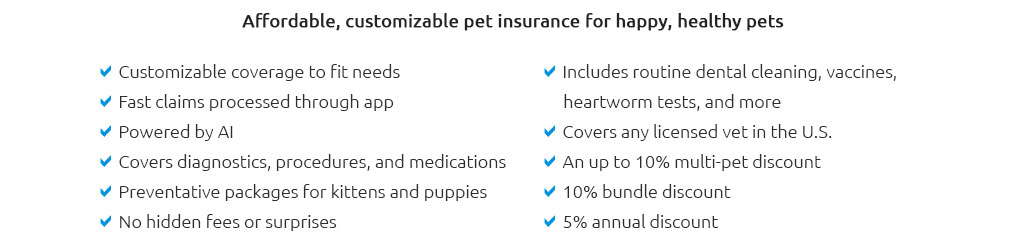

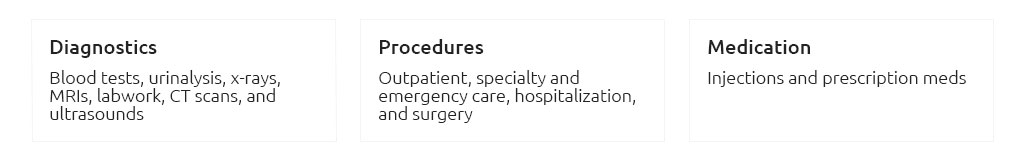

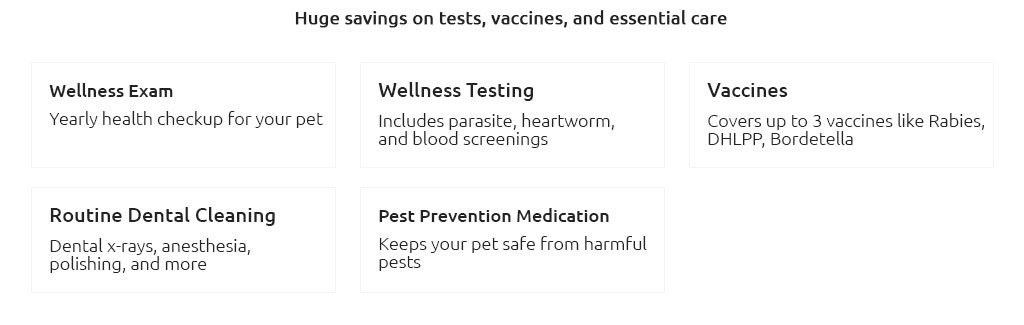

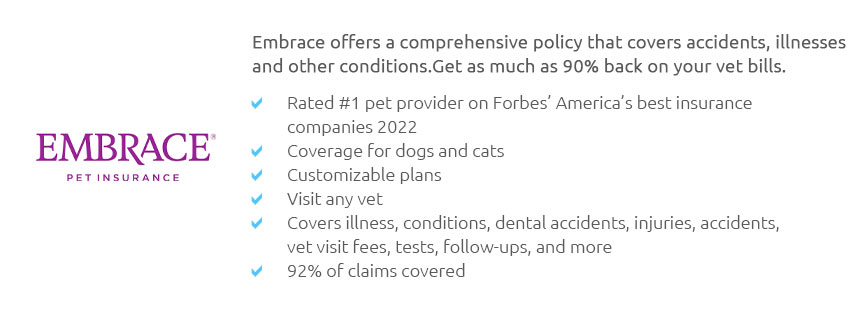

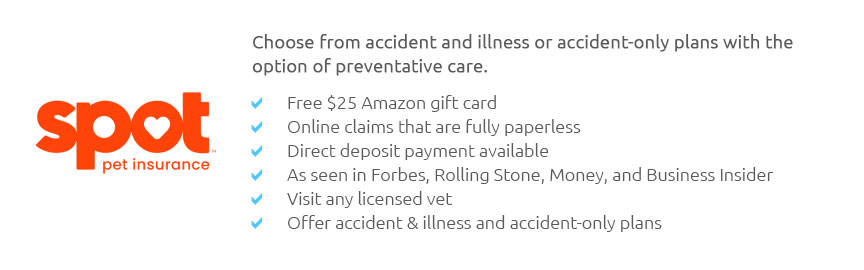

How to Get Pet Insurance for Cat: A Comprehensive GuideUnderstanding Pet InsurancePet insurance is a type of coverage that helps cover veterinary costs when your cat falls ill or gets injured. It's important to understand the different plans and options available to make an informed decision. Steps to Obtain Cat Insurance1. Research Different ProvidersBegin by exploring various insurance providers to find the low price pet insurance options available for your feline friend. Consider the reputation and reliability of each provider. 2. Compare Plans and Coverage

3. Get a QuoteOnce you've narrowed down your choices, request quotes to compare costs. Factors affecting premiums include your cat's age, breed, and health status. 4. Read ReviewsReviews can provide insights into customer satisfaction and claim processing efficiency. A plan from the most common pet insurance companies might offer the reliability you're looking for. Important ConsiderationsWaiting PeriodsMost insurance plans have waiting periods before coverage kicks in. Be aware of these to avoid unexpected costs. Deductibles and ReimbursementsUnderstand how deductibles work and the percentage of costs the insurer will reimburse. FAQs

https://www.healthypawspetinsurance.com/cat-and-kitten-insurance

The Healthy Paws Pet Insurance plan covers your cat from nose to tail. It pays on your actual veterinary bill and covers new accidents and illnesses, ... https://www.aspcapetinsurance.com/cat-insurance/

Visit. Take your cat to the veterinarian of your choice and pay them as usual. - Submit. Use our app to submit a claim even before you leave the veterinary ... https://www.petinsurance.com/cat-insurance/

How does cat insurance work? - visit-any-vet-icon. Visit any specialist. At the first sign of health issues, bring your cat to any licensed veterinarian anywhere ...

|